How To Buy Rental Property With No Money

The real estate market is in a slump, and investors are left with few options. A rental property is a home or building that you can rent to other people. This includes houses, apartments, or hotels. You can buy a rental property with no money or with very little money. This article offers some simple ideas to get started without any money down.

Here is some original way to buy a rental property with no money down

Buying an apartment building with no down payment!

If you've ever asked yourself, "Can I buy a rental property with no money down?" you're far from alone. At some point or another, every real estate investor has asked the same question.

Here are ten ways to buy a rental property without putting any money down. Or less money down. There's no such thing as a free lunch in life, but there are ways to reduce or even get rid of the down payment you need to make on your first rental property.

1. How to buy rental property with House Hacking Real estate investing?

There are a few ways to get started when buying rental property without any money down. One option is to use house hacking techniques, allowing you to purchase a property without qualifying for a traditional loan. Another option is to invest in pre-owned properties. Either way, getting started can be challenging but well worth the effort when it comes to long-term investment opportunities. Always consult with an experienced real estate agent before making any decisions, as the market can change quickly and there are many variables that need to be considered before signing on the dotted line.

2. How to buy a rental property with Seller Financing?

There are a few ways to buy rental property with no money down. One way is to use seller financing. Seller financing is when the buyer pays the seller directly for the property. The seller then pays back the loan with interest over time. This type of loan can be very advantageous for buyers because it allows them to purchase a property without having to come up with any cash upfront. There are a few things that buyers need to keep in mind when using seller financing: 1) The buyer should always have a pre-approved lender in mind before starting the process of looking for properties 2) The interest rate on these loans can be quite high, so it’s important to compare rates before making a decision 3) It’s important to remember that once the sale is completed, the borrower will still have to pay back the loan plus interest.

3. Buying property Assuming the Seller’s Existing Mortgage

Before you even consider buying a rental property, you'll need to determine if it's a good investment. One of the best ways to do this is by assuming the seller's existing mortgage. This will give you a good idea of how much money you'll need to put down and how much your monthly payments will be. Once you have that information, it's time to start looking for properties.

One of the great things about buying a rental property is that it doesn't require a large up-front investment. If you can find a property that's in your budget and meets your needs, putting down just a few thousand dollars could be enough to get you started. Plus, because you're not required to come up with any cash up front, you can always Modify Your Loan if the market takes a turn for the worse.

If you're interested in buying rental property without any money down, be sure to consult with the sellers mortgage lender before committing. They can help you determine if purchasing that rental property is the right decision for you.

4. How can I Rent to Own a property?

If you're like most people who buy a house, you'll need a mortgage to pay for it. You must have a good credit score and enough money for a down payment to qualify. Without these, the traditional way to buy a home might not be possible.

There is an alternative, though. You can rent a house for a certain amount of time and then buy it before the lease is up. There are two parts to a rent-to-own agreement: a regular lease agreement and an option to buy.

- In a rent-to-own agreement, you agree to rent a property for a certain amount of time, but you also have the option to buy it before the lease is up.

- Rent-to-own agreements include both a standard lease agreement and an option to buy the property at a later date.

- Rent-to-own agreements include both a standard lease agreement and an option to buy the property at a later date.

- Lease-option contracts let you buy the house when the lease is up, but with a lease-purchase contracts make you need to buy it.

- During the lease, you pay rent, and often a portion of that payment goes toward the purchase price.

- Some rent-to-own contracts may require you to keep the property in good shape and pay for repairs.

5. What is the BRRRR Method

The BRRRR or "Buy Repair rent refinance "Method is a great way to buy rental properties with no money down.

The BRRRR Method is a great way to buy rental property with no money down. This method allows you to borrow against the equity in your current home, making the process much faster and easier than traditional methods. You can also use this method to purchase properties in a number of different areas, including coastal areas, busy cities, and suburbs.

Here are four things to keep in mind when using the BRRRR Method to buy rental properties:

1. Make sure you have a good credit score when buying in the United States. If you don't already have it, working toward a good credit score will help you get approved for a loan.

2. Have enough money saved up. The minimum amount you need to borrow with the BRRRR Method is 20% of the buying price. The more money you have saved up, the faster the process will go.

3. Get pre-approved for a loan. Many lenders require borrowers to get pre-approved before they begin the purchase process. This gives you an idea of how much money you'll need and gives you time to save that extra money if needed.

6. Real Estate Partnerships

Real estate partnerships can be a great way to buy rental property without any money down. This is because the partnership allows you to borrow money from the partner, who will then own a percentage of the property. This way, you don't have to come up with any money yourself, and the partner can help you find good properties.

7. How can you buy a property with Home Equity Loan?

When you're looking to buy a rental property, you may be wondering if there is a way to do so without any money down. Fortunately, there are a number of options available to you, including using a Home Equity Loan.

When you use a Home Equity Loan to purchase a rental property, the bank loans you the difference between the sale price of the property and your outstanding mortgage balance. This means that you don't need any extra money down (or any credit score!), and the loan can usually be repaid in just five years.

To find out if this is an option for you, speak with a lender who specializes in home equity loans – they can help connect you with the best possible deal. And remember: if buying through a lender isn't an option for whatever reason (maybe there's not enough inventory available), don't worry – there are plenty of other ways to get into rental property loans without having to put up any cash yourself!

8. How can you buy a rental property with Hard Money Lenders?

There are a few different ways that you can buy a rental property with hard money lenders. One option is to become a real estate investor. This means that you will purchase and manage rental properties yourself. Another option is to use a hard money lender as part of a partnership. A hard money lender will provide you with a large loan in order to purchase the property and then you will be responsible for managing it. Finally, you can use a hard money lender to help you purchase an existing rental property. In this case, the hard money lender will provide you with the down payment, including or excluding the repair costs depending on the lender you work with.

The more more money you lend the higher the monthly payment. Once you own the property you will be responsible for the mortgage and other fixed and unexpected costs. Make sure to calculate well if rental property is still a lucrative investment after paying the mortgage and all fixed costs.

If buying through a lender isn't an option for whatever reason (maybe there's not enough inventory available), don't worry – there are plenty of other ways to get into real estate investing without having to put up any cash yourself! For example:

• Use a real estate agent to scout out potential properties.

• Join a free online real estate investment group or syndicate. Most of the time they have online real estate classes you can join.

• Find real estate investment property through online listing services like Zillow, Trulia, Realtor ( you can often save money by negotiating the price down when you when you buy the property with someone that provides you the cash - as then you will be a cash-buyer).

• Sign up for property alerts from reputable websites.

9. Buy rental property with Private Money Lenders with no money of your own

When you are looking to buy rental property with no money of your own, there are a few options open to you. One option is to look into private money lenders. These lenders can provide you with a loan that is designed specifically for buying a rental property, and they often have lower interest rates than traditional banks. You may also be able to find financing through alternative lending sources, such as peer-to-peer loans or private investors. Regardless of the route you choose, it is important to do your research in order to find the best option for you and your financial situation.

10. How to buy a rental property by trading something Other Than Cash

Trading Something Other Than Cash to invest in rental properties can be a great way to get started in the real estate market. There are a few things that you can trade your money for to purchase rental properties. You could trade your money for stocks or bonds, which could give you exposure to real estate markets around the world. You could also trade your money for commodities like gold or silver, which could give you a hedge against inflation or fluctuations in the stock market. Trade Something Other Than Cash is a great way to get started in the real estate market without having to put any money down.

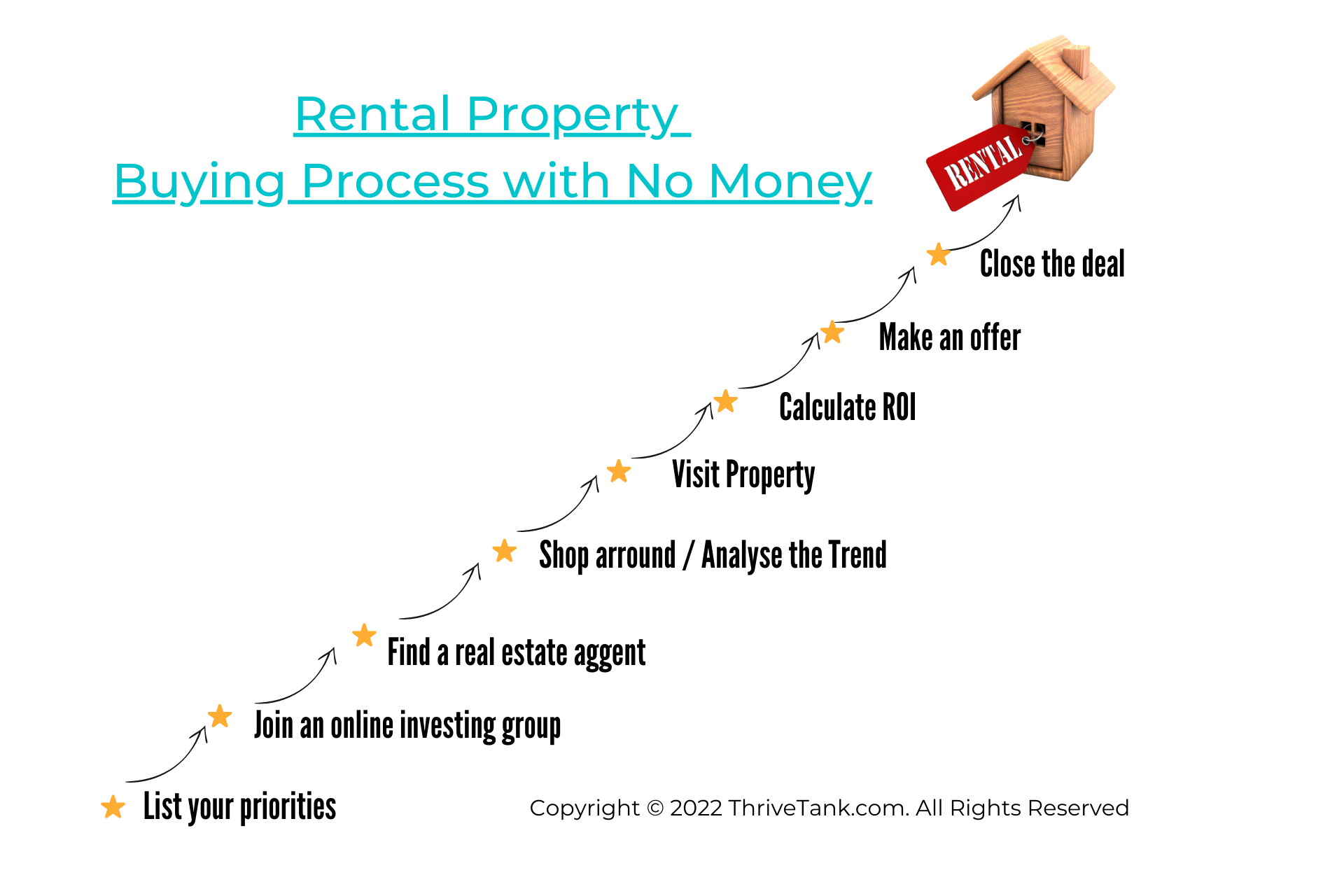

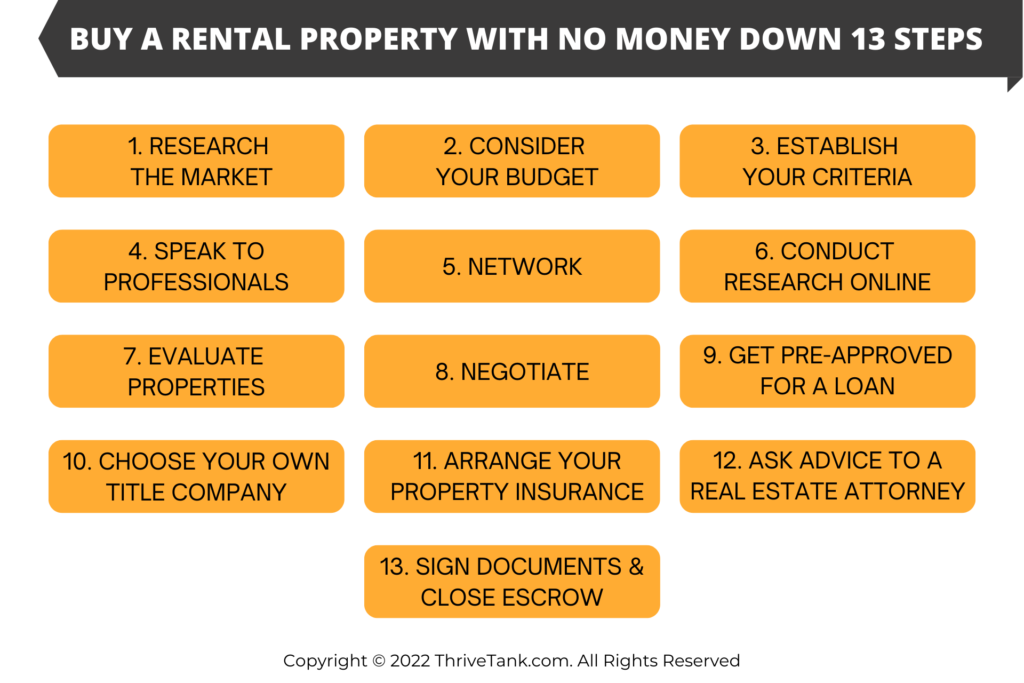

How to buy a rental property with No Money Down 13 Steps

If you’re looking to buy rental property without any money down, there are several things that you need to keep in mind. Here are 10 steps that will help you get started buying a rental property:

1) Research the market – Make sure that you research the current market conditions before starting your search. This will help you determine what type of property is right for you

2) Consider your budget – Once you have an idea of what type of property you want, make sure that you understand your budget limits. This will help you avoid overspending on a property that isn’t within your budget

3) Establish your criteria – Once you have a good understanding of your budget and the market conditions, it’s important to establish some specific criteria for what rental properties meet your needs. This will help narrow down your search for a potential rental property.

4) Speak to professionals and join a free online real estate investing group like bigger pockets – When it comes to buying a rental property, it’s always advisable to speak to professionals who are experienced in this area. They can provide invaluable advice and guidance in buying rental property.

5) Network – If possible, try networking with friends, family members, and other professionals who may have knowledge about the rental market by joining a free online real estate group suggested group BiggerPocket and following their online real estate classes

6) Conduct research online – There are plenty of online resources available that can help you learn more about purchasing properties in the market

7) Evaluate properties – Once you’ve found a few properties that meet your criteria, it’s important to evaluate them carefully including the state of the property

with an official inspection before making any decisions about buying rental property.

8) Negotiate – Once you’ve decided on one or two properties, it’s important to negotiate hard on price and terms. Don’t be afraid to walk away from a deal if necessary. Never buy emotionally, only based on numbers and facts.

9) Get pre-approved for a loan – It’s always wise to get pre-approved for a loan

before you make a downpayment. As you could loose your downpayment if you cannot get a loan after-all.

10) Choose your own title company. To protect you own interest it is important to have your own title company.

11) Arrange your property insurance before closing.

You want your property to be insured the moment you get the keys

12) Ask advice to a real estate attorney. Ask a real estate attorney to verify

your contract before you sign it.

13) Sign documents & close escrow – Finally you only need to sign the contract. Immediately after you signed the contract the title company will give you the keys.

Here are more Strategies for Putting Down Zero Funds When Purchasing an Investment Property

Do you plan on investing any of your retirement funds into rental properties? And what about online financing communities?

Even if you do not plan on making a downpayment you still need to have savings on the side in case you get unexpected repairs in case your water-heater, air conditioner, appliances, roof or others need reparation or maintenance.

For more information on how to save, read our article on how to save money

Conclusion

Investing in rental properties can be a great way to get started without any money down. These simple tips will help you get started buying rental property.

Let us know in the comment bellow where you are in your investment journey.